Welcome to our weekly news post, a combination of thematic insights from the founders at ExoBrain, and a broader news roundup from our AI platform Exo…

Themes this week

JOEL

This week we look at:

- Tiny AI teams hitting millions in revenue with skeleton crews

- Anthropic cuts Claude access to Windsurf amid competitive tensions

- New global map reveals US dominance in AI computing power

Tiny teams with AI take on the world

San Francisco’s AI Engineers World’s Fair returned this June for its second year, drawing 3,000 attendees, up from 2,000 in 2024. The event expanded from 9 to 18 specialised tracks, but the most notable addition was “Tiny Teams” – a track dedicated to founders building multi-million-dollar businesses with skeleton crews.

Bolt.new’s keynote summed up the narrative. Eric Simons’ AI coding app reached $20 million in annual recurring revenue just two months after launch. For context, traditional SaaS companies typically take years to reach similar numbers. Other examples packed the Tiny Teams sessions. Sid Bendre’s four-person team at Alie hit $6 million ARR. Cal AI built a calorie tracking app to $12 million ARR with just four people. OpenArt reached the same revenue with eight people making AI image tools. Solvely.ai’s six-person team generates $4 million annually from AI homework help. Submagic’s 14 employees built a $7 million business in AI captions. Even at the larger end, Icon’s 16-person team hitting $5 million ARR in AI ad creation equates to over $300k per employee. These represent an increasingly new normal where team size and revenue have decoupled.

To put these numbers in context, traditional SaaS companies at similar revenue levels typically achieve $150k to $250k per employee. Even best-in-class public SaaS companies like Dropbox reach $800k per employee. Cal AI’s $3 million per employee and OpenArt’s $1.5 million per employee are significantly higher.

The 2025 conference track list also tells its own story about the industry’s evolution. Last year featured broad categories like “RAG Frameworks” and “Evaluations”. This year brought more precision: GraphRAG, Agent Reliability, SWE Agents, and Voice interfaces. The organisers announced they’d “killed the lazy RAG track everyone does”, replacing it with focused sessions on retrieval, search, and recommendation systems. New additions included the Model Context Protocol (MCP) track, underscoring the protocols continuing rise. Security got its own dedicated track, as did Product Management and Design Engineering. The “AI in the Fortune 500” track ran parallel to “Tiny Teams”, highlighting how established companies are responding to this new reality.

The organisers noted that this was the first such event that they’d run where security was needed in case anti-AI protesters made an appearance (as they did at the recent Microsoft Build conference). Perhaps an indication of things to come. What’s more immediately clear is that the fair has become the premier independent software engineering event globally, with AI as the central organising principle.

Takeaways: The 2025 AI Engineers World Fair documented small teams achieving revenue metrics that defy conventional wisdom. Two months to $20 million ARR isn’t an anomaly anymore. The proliferation of specialised tracks shows an industry moving from broad experimentation to focused execution. For business and tech professionals, the evidence is clear: tiny teams with AI leverage are competing directly with enterprises and winning.

Anthropic leaves Windsurf high and dry

This week, the AI engineering world got a wake-up call when Anthropic abruptly limited Claude API access for Windsurf (a popular AI coding platform we’ve covered in several ExoBrain newsletters). Windsurf reported it received less than five days’ notice before its direct line to Claude 3.x models and the newer Claude 4 series was cut. For developers who had built their workflows around Claude, this was an unwelcome surprise.

Speaking at TechCrunch Sessions just as the news was breaking, Anthropic’s co-founder Jared Kaplan laid out the company line. The main driver? Persistent talk that OpenAI, Anthropic’s chief competitor, was about to buy Windsurf. “I think it would be odd for us to be selling Claude to OpenAI,” Kaplan said, a frank admission of the competitive thinking at play. He also mentioned that Anthropic is “computing-constrained,” a common refrain from Anthropic who struggle the most with rate limits amongst the big labs.

Windsurf, caught in the middle, had to move fast. The company said it was working flat out with third-party providers (AWS) to keep Claude flowing for its paying customers. For others, a “bring-your-own-key” (BYOK) system for Claude access was enabled. Windsurf immediately started pushing Google’s Gemini 2.5 Pro as the go-to alternative, complete with a price cut.

While Windsurf was navigating this turbulence, its main competitor in the AI IDE space, Cursor (parent company Anysphere), was having a decidedly different kind of week. In fact, Anthropic’s Kaplan specifically named Cursor as a company Anthropic expects to work with for a long time. Adding to that, Anysphere announced plans this week for a $900 million funding round. This new investment, led by Thrive Capital and Andreessen Horowitz, Accel, and DST Global, pushes their valuation to $9.9 billion.

This isn’t just a minor blip; since 3.5 Sonnet, Claude has become the go-to model for software engineers, very much preferred over OpenAI’s offerings for coding tasks. But this sudden restriction is a gift to Google, whose Gemini models are a close second and now likely to see increased interest from developers looking for dependable, advanced AI. This is also a reminder that unfettered access to AI models is not a given.

Takeaways: This week’s moves involving Anthropic and Windsurf show that the AI industry is now in a phase where platform politics are very real. Access to leading AI models is not just a technical provision but a strategic asset that can be withdrawn or limited based on competitive dynamics and resource pressures. For any business building on these foundational models, or any developer relying on them, this is a reminder: as ever vendor lock-in or lock-out is a clear and present danger. Diversifying your AI toolkit isn’t just smart, it’s essential.

EXO

EPOCH’s new GPU power map

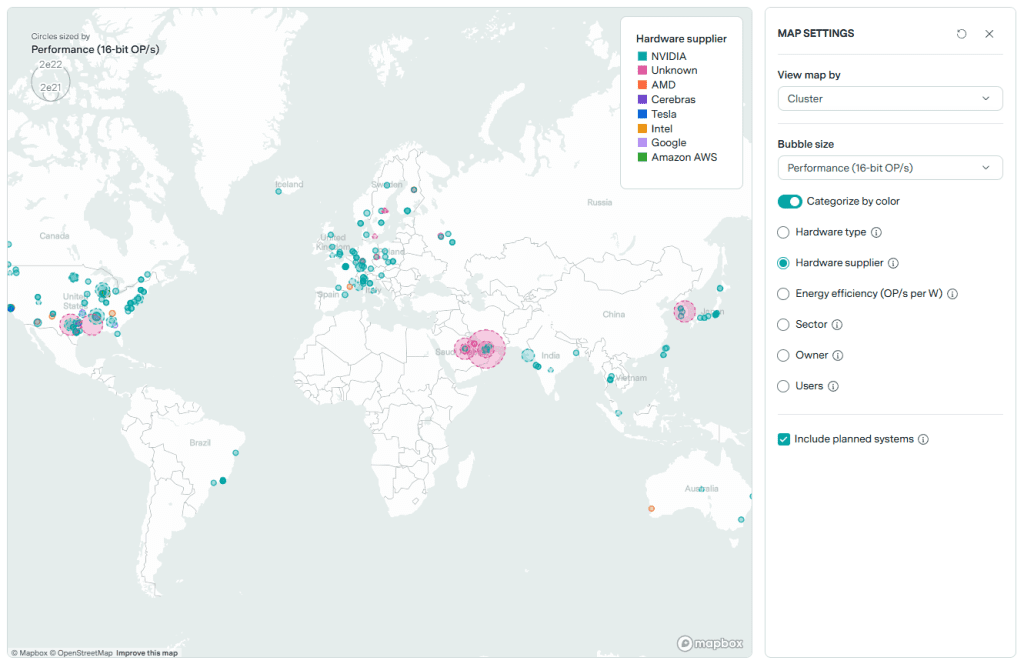

This image from EPOCH’s new database reveals the physical geography of AI progress. The map shows AI clusters worldwide, with bubble size indicating computational performance. NVIDIA hardware (teal) dominates Western infrastructure, whilst China’s systems remain largely “unknown” (pink) highlighting strategic opacity in the AI race. The US hosts 75% of global AI compute, with China holding 15%, and Europe falling behind. The dotted liens show the significant projects planned for the middle east. As companies now control 80% of these systems (up from 40% in 2019), this visualisation captures how GPU power has become a new geopolitical resource, with access determining who shapes AI and economic futures.

Weekly news roundup

This week’s AI landscape shows massive investment flowing into coding assistants and infrastructure, while governance debates intensify around copyright and regulation, and new research reveals advances in how language models reason and self-improve.

AI business news

- UK tech job openings climb 21% to pre-pandemic highs (Signals strong demand for AI talent and suggests the technology is creating rather than destroying jobs in the tech sector.)

- How Morgan Stanley tackled one of coding’s toughest problems (Demonstrates how major financial institutions are leveraging AI to solve complex technical challenges and modernise legacy systems.)

- Anysphere raises $900M for its AI-powered Cursor code editor (Massive funding round validates the transformative potential of AI coding assistants and their rapid adoption by developers.)

- Mistral releases a vibe coding client, Mistral Code (Intensifying competition in AI coding tools market with European alternatives to US-dominated offerings.)

- Alphabet CEO Sundar Pichai dismisses AI job fears, emphasises expansion plans (Major tech leader’s perspective on AI’s net positive impact on employment and economic growth.)

AI governance news

- OpenAI appeals data preservation order in NYT copyright case (Critical legal battle that could set precedents for how AI companies can use copyrighted content for training.)

- Anthropic CEO says proposed 10-year ban on state AI regulation ‘too blunt’ in NYT op-ed (Key perspective from a leading AI safety advocate on finding balanced approaches to AI governance.)

- DeepSeek may have used Google’s Gemini to train its latest model (Raises important questions about model laundering and the ethics of using competitors’ outputs for training.)

- DOGE developed error-prone AI to help kill Veterans Affairs contracts (Cautionary example of rushed AI deployment in government services and its potential consequences.)

- Peers vote to defy government over copyright threat from AI (UK legislative developments that could influence global AI copyright frameworks.)

AI research news

- Self-challenging language model agents (Novel approach to improving model performance through self-generated challenges and iterative learning.)

- Knowledge or reasoning? A close look at how LLMs think across domains (Fundamental research helping us understand whether LLMs truly reason or merely pattern-match.)

- AlphaOne: Reasoning models thinking slow and fast at test time (Advances in test-time reasoning that could significantly improve model performance without retraining.)

- Reflect, retry, reward: Self-improving LLMs via reinforcement learning (Breakthrough in creating models that can autonomously improve their capabilities through experience.)

- Beyond the 80/20 rule: High-entropy minority tokens drive effective reinforcement learning for LLM reasoning (Technical advance in understanding which training data matters most for developing reasoning capabilities.)

AI hardware news

- US-UAE multi-billion dollar AI data campus deal far from finalised, sources say (Geopolitical implications of international AI infrastructure partnerships and technology transfer concerns.)

- Amazon to invest $10 billion in North Carolina to expand cloud, AI infrastructure (Massive infrastructure investment signalling sustained confidence in AI demand and regional economic impact.)

- Broadcom (AVGO) ships gear meant to improve Nvidia (NVDA) AI chip performance (Hardware ecosystem evolution showing how supporting technologies enhance AI chip capabilities.)

- AMD acquires team behind AI chip startup Untether AI (Strategic talent acquisition highlighting intensifying competition in the AI hardware market.)

- Tech giants’ indirect emissions rose 150% in three years as AI expands, UN agency says (Critical environmental impact data revealing the hidden costs of AI’s rapid expansion.)